Pvm Accounting - The Facts

Pvm Accounting - The Facts

Blog Article

The Buzz on Pvm Accounting

Table of ContentsPvm Accounting for BeginnersLittle Known Questions About Pvm Accounting.Pvm Accounting - Questions8 Simple Techniques For Pvm AccountingSome Ideas on Pvm Accounting You Need To KnowSome Of Pvm Accounting

Oversee and deal with the production and approval of all project-related invoicings to consumers to foster great interaction and avoid problems. construction bookkeeping. Make certain that suitable records and documentation are submitted to and are upgraded with the IRS. Make sure that the audit procedure follows the legislation. Apply needed building accounting requirements and procedures to the recording and reporting of building and construction task.Understand and preserve basic expense codes in the audit system. Connect with various funding firms (i.e. Title Firm, Escrow Firm) regarding the pay application process and demands needed for settlement. Handle lien waiver dispensation and collection - https://justpaste.it/g184p. Screen and solve financial institution concerns consisting of cost abnormalities and inspect differences. Help with carrying out and preserving interior financial controls and treatments.

The above statements are planned to define the general nature and level of job being executed by individuals designated to this classification. They are not to be interpreted as an exhaustive checklist of duties, obligations, and abilities needed. Personnel might be needed to carry out duties beyond their typical responsibilities from time to time, as required.

Pvm Accounting Things To Know Before You Get This

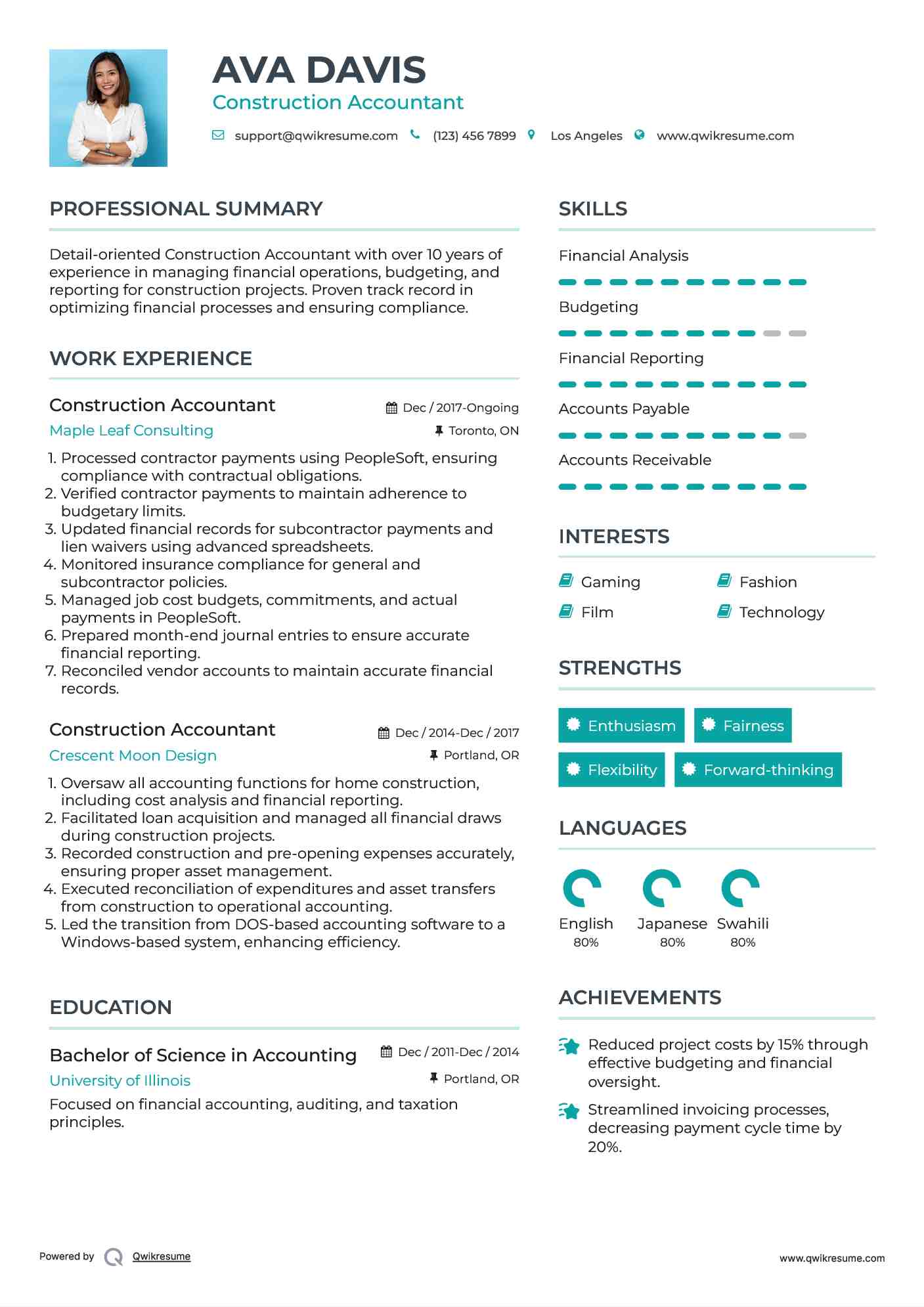

You will certainly help support the Accel group to make sure distribution of successful on time, on budget plan, tasks. Accel is seeking a Building Accountant for the Chicago Office. The Building and construction Accountant executes a variety of audit, insurance coverage conformity, and task administration. Functions both independently and within particular divisions to maintain monetary documents and ensure that all documents are maintained current.

Principal tasks consist of, but are not limited to, managing all accounting features of the firm in a prompt and accurate manner and offering records and schedules to the company's CPA Firm in the preparation of all monetary statements. Makes certain that all accounting procedures and functions are managed accurately. In charge of all monetary documents, pay-roll, financial and everyday procedure of the audit feature.

Functions with Project Supervisors to prepare and publish all monthly billings. Generates month-to-month Task Cost to Date records and working with PMs to resolve with Project Supervisors' budget plans for each task.

The smart Trick of Pvm Accounting That Nobody is Talking About

Efficiency in Sage 300 Construction and Genuine Estate (formerly Sage Timberline Workplace) and Procore building and construction management software application an and also. https://www.tripadvisor.in/Profile/pvmaccount1ng. Must additionally be skilled in various other computer software application systems for the prep work of records, spreadsheets and other audit analysis that may be needed by monitoring. Clean-up accounting. Must possess solid business skills and ability to focus on

They are the financial custodians who make certain that construction jobs remain on budget plan, comply with tax regulations, and preserve monetary openness. Building and construction accounting professionals are not just number crunchers; they are tactical partners in the building process. Their main function is to handle the monetary facets of building and construction projects, guaranteeing that resources are designated effectively and monetary dangers are lessened.

Some Known Questions About Pvm Accounting.

By maintaining a limited grip on task finances, accounting professionals help protect against overspending and monetary setbacks. Budgeting is a foundation of effective building tasks, and building accountants are critical in this regard.

Building accounting professionals are well-versed in these policies and guarantee that the job abides with all tax obligation needs. To succeed in the duty of a construction learn the facts here now accountant, individuals need a solid educational foundation in accounting and finance.

Additionally, accreditations such as Cpa (CERTIFIED PUBLIC ACCOUNTANT) or Licensed Building Market Financial Expert (CCIFP) are extremely concerned in the industry. Functioning as an accounting professional in the building and construction sector features a special set of difficulties. Construction projects often involve limited due dates, altering policies, and unexpected expenditures. Accounting professionals need to adapt quickly to these obstacles to maintain the job's financial wellness undamaged.

What Does Pvm Accounting Mean?

Ans: Construction accounting professionals create and check budget plans, recognizing cost-saving chances and ensuring that the job remains within budget plan. Ans: Yes, building and construction accountants take care of tax conformity for building and construction jobs.

Intro to Building Bookkeeping By Brittney Abell and Daniel Gray Last Updated Mar 22, 2024 Building and construction companies have to make hard options amongst many monetary choices, like bidding on one job over one more, picking financing for materials or tools, or setting a project's revenue margin. In addition to that, construction is a notoriously unpredictable sector with a high failing price, slow-moving time to settlement, and inconsistent capital.

Production includes duplicated processes with quickly recognizable prices. Production needs various procedures, materials, and equipment with differing prices. Each project takes place in a new place with differing website conditions and distinct difficulties.

Our Pvm Accounting Statements

Frequent usage of various specialty contractors and suppliers influences effectiveness and money flow. Settlement shows up in full or with normal repayments for the full agreement quantity. Some portion of settlement might be withheld up until project conclusion even when the contractor's job is completed.

Regular manufacturing and short-term agreements result in manageable capital cycles. Uneven. Retainage, sluggish payments, and high ahead of time costs bring about long, irregular cash circulation cycles - construction bookkeeping. While conventional makers have the advantage of regulated environments and enhanced manufacturing processes, building and construction business have to frequently adapt per new job. Also somewhat repeatable jobs require adjustments as a result of site problems and other aspects.

Report this page